Veterans Affairs (VA) home loans are a popular option for service members, veterans, and their families due to their competitive interest rates, no-down-payment requirements, and lack of private mortgage insurance (PMI). However, understanding the current interest rates for VA loans is essential for anyone looking to purchase or refinance a home through this program. Let’s dive into how VA loan rates are determined, what factors influence them, and where current rates stand.

Understanding VA Home Loan Rates

Unlike conventional mortgages, VA home loans are partially guaranteed by the Department of Veterans Affairs. This guarantee reduces the lender’s risk, which often allows them to offer lower rates. However, the VA does not set specific interest rates for these loans. Instead, rates are determined by individual lenders based on several market-driven factors.

Factors Affecting VA Loan Rates

1) Federal Reserve Policy: The Federal Reserve doesn’t set mortgage rates directly, but its policies on federal fund rates can influence the overall mortgage market. When the Fed raises rates to control inflation, mortgage rates often rise, and vice versa.

2) Economic Conditions: Inflation, unemployment rates, and economic growth all play a role in determining interest rates. For instance, when the economy is booming, rates may increase due to higher demand for borrowing.

3) Credit Score: VA loan rates can also vary based on the borrower’s creditworthiness. While VA loans are more lenient with credit scores compared to conventional loans, those with higher credit scores generally receive better rates.

4) Loan Term and Type: VA loans offer both fixed and adjustable-rate mortgages (ARMs). Fixed-rate loans tend to have higher initial rates but provide stability over time. Adjustable-rate VA loans usually offer lower initial rates that adjust based on market conditions after a set period.

5) Down Payment and Loan Amount: While VA loans do not require a down payment, making one can sometimes result in better terms or rates. Similarly, a higher loan amount might influence the rate due to higher perceived risk.

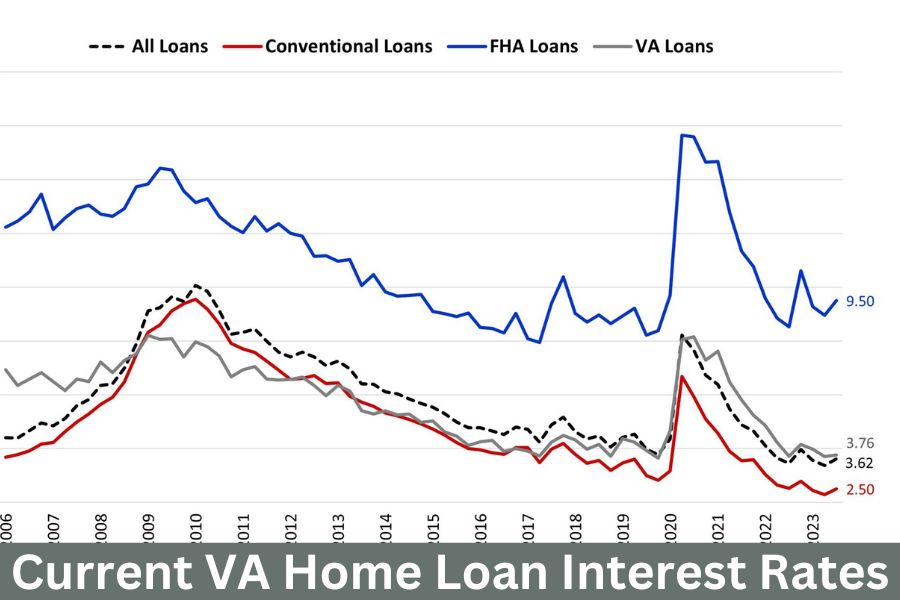

Current VA Loan Rates (As of November 2024)

As of the latest updates, VA loan interest rates are generally sitting between 6% and 7% for fixed-rate loans. Rates may vary slightly depending on the lender and the specific loan terms.

1) 30-Year Fixed VA Loan: The average rate is currently around 6.5%, although this can vary based on lender and borrower factors.

2) 15-Year Fixed VA Loan: Shorter terms like the 15-year fixed-rate VA loan are currently averaging closer to 6.25%. This option can help borrowers save on interest over time but involves higher monthly payments.

3) 5/1 VA Adjustable-Rate Mortgage (ARM): For those considering an adjustable-rate VA loan, the starting rate might be lower, around 6%. However, it’s important to remember that the rate may fluctuate after the initial fixed period, depending on market conditions.

How to Get the Best Rate on a VA Loan

Here are some tips to help you secure the most favorable rate on a VA loan:

1) Compare Lenders: Even a slight variation in rates can have a significant impact on the life of the loan, so it’s worth comparing offers from multiple VA-approved lenders.

2) Boost Your Credit Score: Taking steps to improve your credit score, such as paying down debt and making timely payments, can help you qualify for a better rate.

3) Consider a Larger Down Payment: Although VA loans don’t require a down payment, putting some money down can sometimes lead to lower rates.

4) Monitor Rate Trends: Interest rates fluctuate regularly, so keeping an eye on economic news and Fed announcements can help you time your loan application for when rates are most favorable.

Why Choose a VA Loan?

VA loans offer many benefits that make them appealing beyond just competitive interest rates:

1) No Down Payment: Eligible borrowers can purchase a home without the need for a down payment.

2) No Private Mortgage Insurance (PMI): VA loans don’t require PMI, saving borrowers money compared to conventional loans.

3) Flexible Credit Requirements: VA loans often have more lenient credit requirements than conventional loans.

4) Refinancing Options: VA loans offer an Interest Rate Reduction Refinance Loan (IRRRL) option, commonly known as a VA Streamline Refinance, which can make it easier for current VA loan holders to reduce their rate or switch loan terms.

Conclusion

VA home loans offer competitive interest rates, especially for eligible borrowers who take advantage of their benefits. While current rates range around 6-7%, remember that these rates are influenced by broader economic conditions and individual financial factors. By understanding these elements and comparing lender offers, VA loan applicants can make well-informed decisions, securing the best possible terms on their home purchase or refinance.